Our Services

We provide end-to-end guidance tailored to your unique business, family dynamics, and financial goals. Our services are designed to protect value at every stage of the transition process:

- Exit Strategy Planning: Craft a customized roadmap for your ideal exit, whether selling to a strategic buyer, merging with a competitor, or stepping back while retaining income. We align timing, structure, and goals to optimize outcomes.

- Succession Planning: Identify, develop, and empower the next generation of leaders, family members or key employees, to ensure operational continuity and cultural preservation long after you’ve stepped away.

- Risk Reduction: Proactively address legal, operational, and market risks that could derail a transition. From key-person insurance to contingency contracts, we build safeguards into every plan.

- Value Preservation: Implement pre-transition improvements such as cleaning up financials, strengthening management teams, and diversifying customer bases—to enhance business valuation and appeal to buyers.

- Tax Efficiency: Structure the transaction to minimize capital gains, estate, and income taxes using tools like installment sales, trusts, charitable remainder trusts, or ESOPs. Our strategies are designed in collaboration with your tax and legal advisors.

- Family Succession: Navigate the emotional and financial complexities of keeping the business in the family. We facilitate governance structures, buy-sell agreements, and training programs to support a smooth, equitable handover.

- Employee or Buyer Transition: Structure management buyouts (MBOs), employee stock ownership plans (ESOPs), or sales to third-party buyers with clear terms, financing options, and earn-out provisions to protect your interests.

- Financial Security: Ensure the proceeds from your exit are reinvested wisely to support your retirement, philanthropy, or next venture. We integrate liquidity planning with wealth management to provide lifelong income and growth.

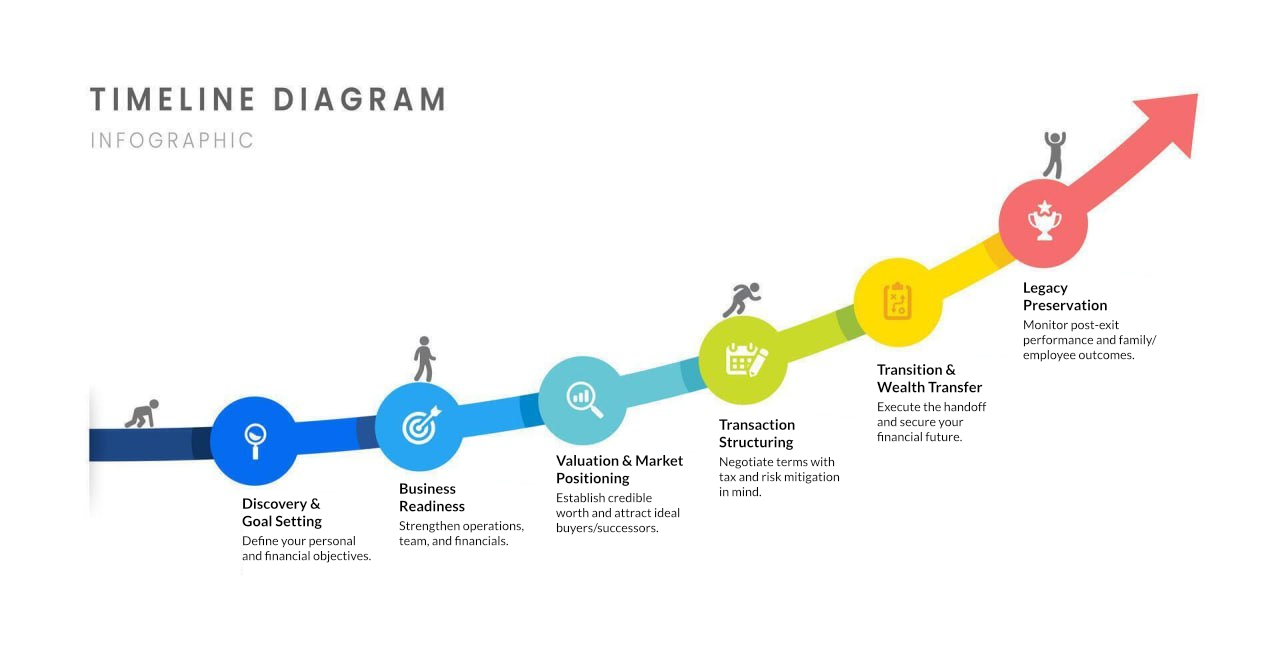

Succession is a Process, Not an Event

Contact Us Today

The best time to plan your exit was five years ago. The second-best time is now. Whether you’re exploring options, grooming a successor, or ready to launch a sale process, our team is here to provide clarity, reduce risk, and help you achieve the outcome you deserve. Click on the “book a discovery call” button to get on our calendar or give us a call.

Don’t guess, plan with purpose!