Our Services

We offer a comprehensive suite of services designed to address every aspect of your income and retirement needs. Our team of experienced advisors works closely with you to develop tailored solutions that align with your unique financial situation, goals, and risk tolerance. Below, we outline our key offerings:

- Monthly Distributions: We design a customized distribution plan from your investment portfolio that provides reliable monthly income while prioritizing the preservation of your principal. This approach helps mitigate the risks of market volatility and inflation, ensuring your funds last as long as you do.

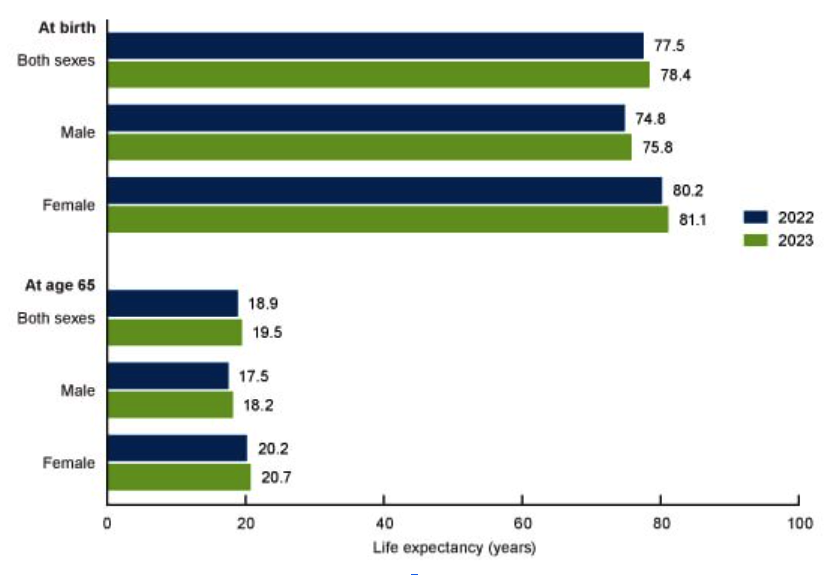

- Longevity Planning: Anticipating a longer retirement horizon, we create strategies that account for extended lifespans, including healthcare costs, lifestyle adjustments, and potential market shifts. Our plans focus on building resilience into your portfolio for a fulfilling and worry-free future.

- Required Minimum Distributions (RMDs): We provide expert guidance to help you comply with federal and state RMD requirements from retirement accounts like IRAs and 401(k)s. Our strategies aim to minimize tax impacts while integrating these distributions seamlessly into your overall income plan.

- Income Planning: Crafting a sustainable income stream is at the heart of retirement success. We analyze your assets, expenses, and goals to develop a diversified plan that draws from multiple sources—such as dividends, interest, and systematic withdrawals—to support your desired lifestyle without depleting your nest egg prematurely.

- Tax Strategies: Taxes can erode your retirement savings if not managed properly. We implement tax-efficient investment techniques, such as asset location, Roth conversions, and charitable deductions, to optimize your plan and potentially reduce your overall tax burden.

- Asset Preservation & Reallocation: Protecting your wealth from market downturns and life changes is essential. We regularly review and reallocate your portfolio to maintain balance, incorporating conservative strategies like diversification and hedging to align with your evolving objectives.

- Account Titling & Beneficiaries: Proper account structuring ensures your assets are protected and transferred efficiently. We assist in reviewing and updating titling options (e.g., joint tenancy, trusts) and beneficiary designations to avoid probate issues and align with your estate planning wishes.

- Multigenerational Wealth Transfer: Legacy planning goes beyond your lifetime. We help structure plans for seamless wealth transfer to children, grandchildren, or other heirs, using tools like gifting, trusts, and life insurance to minimize taxes and preserve family harmony.

- Charitable Giving: If philanthropy is important to you, we integrate giving strategies into your plan, such as donor-advised funds or qualified charitable distributions, allowing you to support causes you care about while enjoying potential tax benefits.

Disclaimer

Required Minimum Distributions (RMDs) are generally subject to federal income tax and may be subject to state taxes, depending on your jurisdiction. It's important to note that Raymond James and its advisors do not provide tax or legal advice. We strongly recommend consulting with a qualified tax professional or attorney to address any specific tax or legal concerns related to your financial situation. This ensures that all decisions are made with the most accurate and personalized guidance.

Contact Us Today

Don’t procrastinate. It's worth your mental health and peace of mind to get a plan in place today. Hit the “book a discovery call” button today to get on our calendar. Your future self will be so glad that you took care of this and didn’t leave it up to chance.

Don’t guess, plan with purpose!